Bison Trails allows the user to run secure infrastructure on multiple blockchains.

Visit

Our mission is to partner with exceptional founders at

the very inception of their entrepreneurial journey.

When others wait, we Charge.

NYC

HQ

Pre-Seed

/ Seed

72

investments$5B+

portfolio market cap

Bison Trails allows the user to run secure infrastructure on multiple blockchains.

Visit

Clay is a CRM for API-first companies to acquire, engage, retain and monetize developers.

Visit

Electric is an information technology company that helps businesses manage their IT security, support, and devices in real-time.

Visit

Eliion is a digital health solutions marketplace for healthcare builders to discover, evaluate, and select the software and services they need to run their businesses.

Visit

Fonzi matches elite engineers with AI startups and high-growth tech companies. It’s easy, fast, and discreet.

Visit

GRIN is a marketing software that enables direct-to-consumer brands to collaborate and manage their relationships with influencers.

Visit

Higgsfield is a new foundational video AI model company that facilitates social media creation for everyone.

Visit

Using AI to identify sources of harm and eliminate them by using the litigation system to hold responsible parties to account.

Visit

Lexent Bio is using novel liquid biopsy cutting edge technology to change the way we manage cancer.

Visit

Managed state compliance company that changes the way remote businesses are operating around compliance, tax, legal, and back office in any jurisdiction.

Visit

Nara Organics manufactures organic infant formula delivered directly to the consumers.

Visit

AI-native social operating system for authentic community management, real time listening, and driving revenue for brands at scale.

Visit

NOAT produces nicotine pouches that are oat-based, pH-neutral, and designed to be gentle on your mouth and gums.

Visit

Podz is a podcast discovery platform that identifies and transforms the podcast episodes into a personalized feed of animated highlights.

Visit

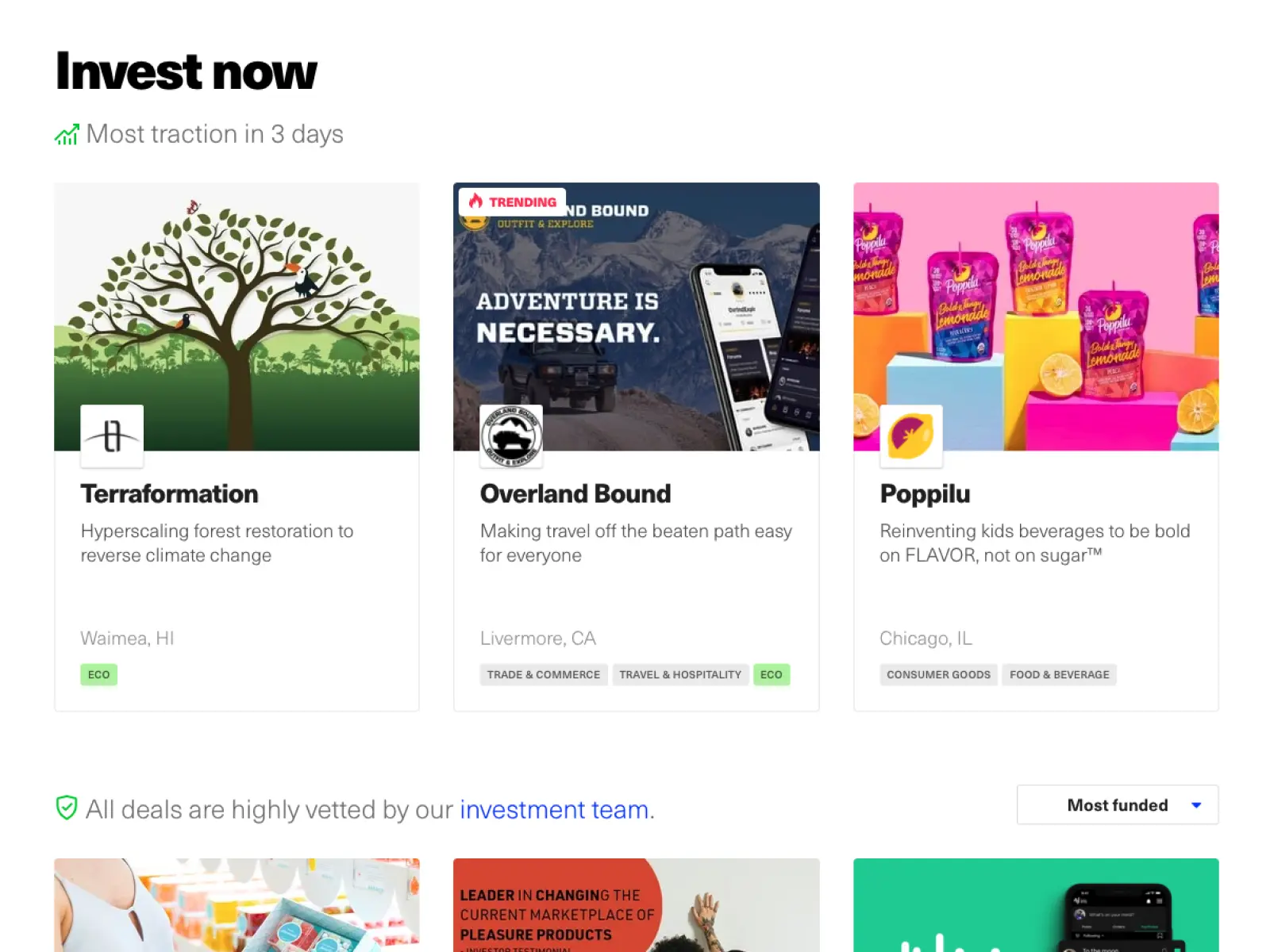

Republic gives people power to invest in startups, real estate, blockchain, video games, and more.

Visit

Transfix is a freight marketplace connecting shippers to a national network of reliable carriers.

VisitKPIs including ARR CAC LTV

* With the generous support of the Ewing Marion Kauffman Foundation for Entrepreneurship

https://www.kauffman.org/

As an enthusiastic group of serial entrepreneurs, investors, data scientists, and academics, there's nothing we'd rather do than help passionate founders realize their vision.

Charge is a data-driven VC fund. Our proprietary technology enables Charge to identify and reach out to promising founders beyond our immediate network.

Charge focuses on non-traditional startup geographies across America, including NYC, Chicago, Atlanta, Boston, San Diego, Miami, and beyond.

Charge focuses on pre-seed and seed stage investments. We frequently invest alongside angels, often the first institutional check a company receives.

We have a bias toward data-driven software companies with a strong product sense and bottoms-up growth, often investing in low code tools, AI/ML, the creator economy, marketplaces, D2C healthcare and the future of work.

Charge initially invests anywhere from $250K - $750K, often deploying millions into follow on rounds via SPV.